Table of Contents

- Jamie Eaton on LinkedIn: Have you maxed out your 401(k) match and your ...

- Roth Ira Contribution Limits 2025 Over 50 - Ladan Bailey

- Catch-Up Contributions Into a Roth 401(k) Isn't a Bad Idea | Kiplinger

- Roth 401 K

- Notable 401(k) and IRA plan changes for 2025 | Accounting Today

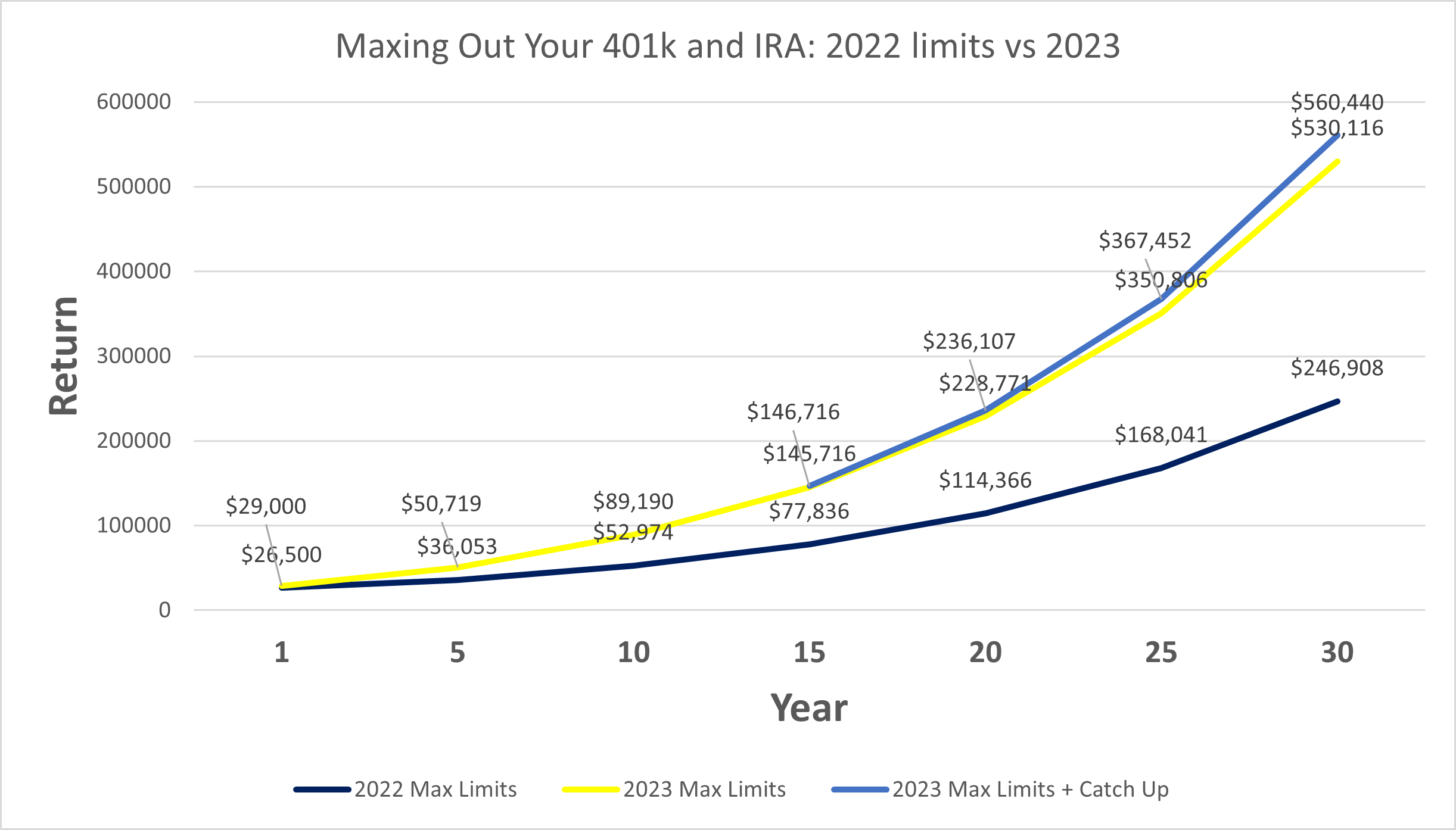

- New 401(k) and IRA Limits Could Equal an Additional 300k in Your Pocket ...

- Catch-Up Contributions Into a Roth 401(k) Isn't a Bad Idea | Kiplinger

- The IRS has announced 3 key changes to 401(k)s for 2025 — here's how to ...

- Catch-Up Contributions Into a Roth 401(k) Isn't a Bad Idea | Kiplinger

- Contribution Limit Increases For Tax Year 2025 For 401(k)s and IRAs ...

Understanding 401(k) Contribution Limits

2025 401(k) Contribution Limits

Benefits of Maximizing Your 401(k) Contributions

Maximizing your 401(k) contributions can have significant benefits for your retirement savings. By contributing the maximum amount allowed, you can: Reduce your taxable income, lowering your tax liability Grow your retirement savings more quickly, thanks to compound interest Take advantage of employer matching contributions, if available Ensure a more comfortable retirement, with a larger nest egg to draw from In conclusion, the 2025 401(k) contribution limits offer individuals an opportunity to boost their retirement savings. By understanding the limits and maximizing your contributions, you can set yourself up for a more secure financial future. Remember to check with your employer or plan administrator for the most up-to-date information and to take advantage of any employer matching contributions. With careful planning and strategic saving, you can make the most of your 401(k) plan and achieve your retirement goals.Stay informed about the latest retirement savings news and updates by following Yahoo and other reputable financial sources. By staying ahead of the curve, you can make informed decisions about your retirement savings and ensure a brighter financial future.